Jamaica Sweepstakes Fraud Targets Older People

Older Americans and Canadians are being clobbered by prize and sweepstakes schemes, with the majority of this fraud coming from Jamaica. These are mainly telemarketing schemes. In a typical call the scammer will pretend to be with Publisher’s Clearinghouse or the Mega Millions lottery, telling the victim that they have won several million dollars – but not to tell anyone. They are also promised a free brand new car, usually a Mercedes, which will be delivered later in the afternoon. They are often even asked what color car they want. This is, of course, in addition to the money, which the fraudsters promise will be delivered the next day. While the victim is contemplating the great things they could do for their friends, families and communities the caller also notes that money must be sent in advance to cover taxes owed to the IRS, insurance, or some other made up reason. If victims send the money there are inevitably requests for additional money.

No one ever receives any winnings. If it is possible to make matters worse, the frauds are also using the information they gather to divert the victim’s social security and VA benefits to themselves. Calls will usually continue until the victim has no more money and has borrowed all they money they can

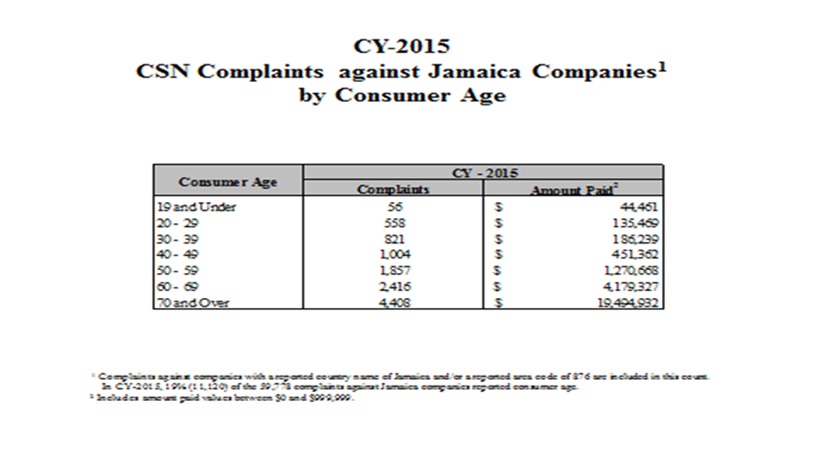

It is clear that those conducting this fraud are targeting older people. 60,000 victims reported losing over $38 million to Jamaica in just 2015. About half of the victims were over 70 years old.

I estimate that there may be at least a billion of dollars every year going to Jamaica from this fraud. Not only does this devastate the lives of victims, those who refuse to or can’t send more money are sometimes subject to death threats.

This fraud is also having a devastating effect on Jamaica itself. There were 1196 murders in Jamaica last year, which authorities there believe are largely the result of rival telemarketing gangs seeking lead lists of potential victims. In addition, many young people in Jamaica are turning to fraud instead of employing their talents to build the Jamaican economy.

This article attempts to give an idea of the size of this problem, explain how the scammers contact victims and keep them sending money, cover how the money is collected, describe law enforcement efforts, and provide some of the challenges and suggestions on what to do when encountering victims or assisting concerned loved ones.

Sanjay Williams

The case of Sanjay Williams provides a good illustration of how this fraud works. Sanjay, a Jamaican, seems to have begun his career making telephone calls to older people in the U.S. Federal authorities allege that he himself had over 80 victims, with total victim losses of more than $5.5 million. Williams told his prospective senior victims that to get their prize winning they needed to pay fees for taxes, insurance, or other reasons. Some victims lost only $300. At least one victim lost $850,000. Williams also used threats of violence against victims and their families to extort more money. He told one victim that he would kill their sons and rape their daughters. Another of Williams’ victims committed suicide.

At some point Sanjay William decided to get into the lead list business, selling contact information of potential victims to other Jamaican fraudsters. He apparently sought leads with information on people who had responded to mailings promising that they had won a large sum and simply needed to send back $20 or so in order to obtain their winnings (these mailings will be the subject of a later article). Williams was buying these in the U.S. for as much as $5.50 per name, and sold them to his coconspirators and some 400 other fraudsters in Jamaica.

He was arrested when he visited the U.S. to obtain leads, and was prosecuted by the U.S. Attorney’s office in the District of North Dakota. That office has concentrated on Jamaican fraud and it doing an awesome job. The FBI and Postal Inspection Service are credited with doing the supporting investigation. A representative of the Major Organized Crime and Anti-Corruption Agency (MOCA), Lottery Scam Task Force, in Jamaica, testified at the trial as an expert witness. An official from MOCA in Jamaica emphasized the willingness of Jamaican law enforcement officials to continue to work in partnership with their United States counterparts to fight the ongoing scourge of the lottery fraud, and to assist in the efforts to bring the remaining indicted Jamaican defendants to trial in North Dakota.

After trial Sanjay Williams was convicted by a jury. On November 24 of 2015 he was sentenced to 20 years in federal prison and ordered to pay $5.6 million in restitution to victims.

(Note: I testified at the sentencing hearing on behalf of the FTC).

Here are some articles dealing with Sanjay Williams

http://www.reuters.com/article/usa-north-dakota-fraud-idUSL1N0XY36W20150507

How big a problem are lottery/sweepstakes scams from Jamaica?

I would estimate the U.S. and Canadian victims, most of them older, are sending at least $1 BILLION each year to Jamaica. How do we know how much fraud there is? We can extrapolate from complaints filed by victims and the results of fraud surveys conducted by the FTC.

The FTC maintains the Consumer Sentinel Database. This includes, of course, complaints made directly to the FTC. In addition, a number of other entities download their complaints into Sentinel. Thus complaints made to the Better Business Bureau, Publisher’s Clearing House, Western Union, MoneyGram, Green Dot, the Postal Inspection Service and many (not all) of the State Attorney General’s also contribute complaints to the Sentinel database. Thus Sentinel contains the best data available on consumer fraud in the country. Over 3000 law enforcement agencies can log into Sentinel over the internet. It is fairly easy to search. Every year the FTC releases a report synthesizing the data, even breaking it down state by state.

Sentinel categorizes different types of fraud complaints. In 2015 the FTC received 140,136 complaints about supposed lotteries and prize winnings, up from 103,000 the year before in 2014. (This complaint category also includes sweepstakes mailings, not just telemarketing calls, but the FTC gets very few complaints about mailings. My estimate is that over 95% of these complaints involve telemarketing). In one period of just 2 ½ years (2011, 2012 and first half of 2013) consumers reported losses to sweepstakes scams totaling $416 million.

We also know that many victims never complain, or do not know who to complain to (other than the local police). An FTC survey several years ago found that only 8.4% of fraud victims ever complained to law enforcement or the Better Business Bureau – meaning that over 90% of victims never complain. In addition, note that local police that receive these complaints do not themselves enter their reports into the Consumer Sentinel database and may themselves not know where else victims should complain.

How many of these calls were from Jamaica? I suspect the majority of them. But the victim reporting this does not necessarily know who they are truly dealing with, especially since the callers often pretend to be Publisher’s Clearing House. In addition, in recent years the only other locality I am aware of that engages in Sweepstakes calls is Costa Rica. A unit at DOJ has done some very good work prosecuting those making such calls from Costa Rica, especially since many of the callers are U.S. citizens. But it seems clear that most of these calls in fact come from Jamaica.

Consumers will only know that they are dealing with Jamaica two ways: First, if they send money directly to Jamaica. Second, if they capture a caller ID that shows that the call came from Jamaica’s area code – 876. As I explain below, currently a large amount of the money is first received by “mules” in the U.S. In addition, not everyone has caller ID, and many frauds “spoof” the phone number to make it appear it is coming from somewhere else. The Las Vegas area code 702 is a particular favorite of the scammers.

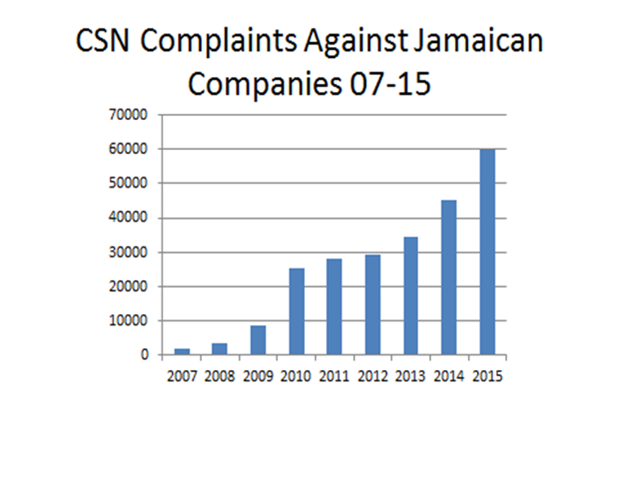

So let’s look just at complaints we know involve Jamaica. The trend line alone demonstrates that the problem is increasing:

Note that this includes all complaints about Jamaica. However, over 95% involve lottery or sweepstakes fraud.

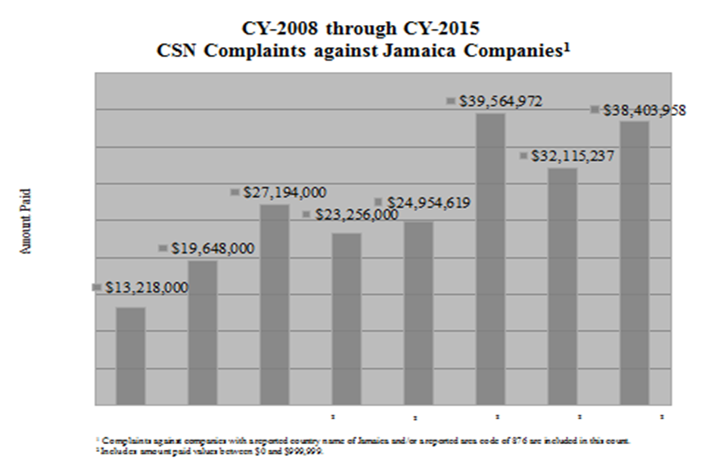

Next let’s look at reported losses to Jamaican fraud. Of course some complaints do not provide loss numbers. But for even those complaints that get reported, and which we know involve Jamaica, losses just in 2015 amounted to over $38 million.

What do all of these numbers mean? I fear that many people believe that this fraud only occurs rarely. But these numbers demonstrate that this fraud is all around us and that our own friends and relatives are being victimized – or are likely to be. It is the rare town or neighborhood that does not have someone who has been defrauded. A new program from the BBB allows you to view a graphic display and see how many complaints about consumer fraud have been made just to the BBB’s from your town. https://www.bbb.org/scamtracker/us

Who are the targets of this fraud?

The Jamaicans are clearly targeting older consumers. Some studies suggest that older consumers are, overall, somewhat less likely to be a fraud victim than the public at large. After all, these people have some life experience to guide them. In the case of Jamaica, however, this is clearly NOT the case.

As you can see, more than half of victims are over 60, and those over 70 years old account for more than two thirds of the losses.

Why does this fraud work?

Many of us conclude that this could never happen to us. We all believe that using our native caution we would be able to quickly detect that these are frauds. I wish that were true. But in my experience most fraud victims are perfectly normal people. Their normal tools for detecting deception simply don’t work against the frauds. Here are a few reasons why this is true.

The crooks are professionals. These frauds are carefully constructed. Those doing them are professionals, and have scripted answers for any question you pose them. They also tell people that they must move immediately or the award will be given to someone else. You may be able to detect is your friends or family are fibbing to you, but you won’t be able to detect it from talking to the crooks over the telephone. Consumers may be able to detect small inconsistencies, but the idea that the entire transaction is a total fraud (the Big Lie) is more than most people can grasp.

They are telling you something you want to believe. Millions of people buy lottery tickets and enter sweepstakes, and of course at times someone does win. People like to believe that it is their turn. In my experience victims are not overcome with greed. Instead they are encouraged to think about the nice things they can do for their families or communities with the money. Perhaps they want to help out a relative in financial distress, or have a grandchild that wants to go to college. For many seniors it may be a way to increase their importance in the lives of their families.

Victims are told to keep this secret. The crooks caution victims that they must not tell anyone about this award before they receive their winnings. This makes it less likely that the victim will consult with someone else before sending their money.

I believe that the complaints show that most victims lose money once, and then move on. But some people, chronic victims, continue sending money. Some victims (the Jamaicans call them Whales) just keep sending money while they are strung along with reasons why they must send more and more on a variety of pretexts. There are many consumers who have lost hundreds of thousands of dollars in a vain attempt to collect their “winnings.” And these victims are told to pay various fees for taxes, insurance, courier fees, airport taxes, document fees or other reasons, usually over several weeks, months or even years. The skilled fraudsters learn all they can about an elderly victims’ assets and ability to borrow cash, take advances on credit cards, obtain loans on their homes or cars, or even cash our stocks or other retirement savings. The scammer may even pretend to put in their own money, as an advance to help pay those taxes. Scammers are also known to have sent flowers, birthday cards, and pose as a real friend (often calling daily -- more than family or ‘real friends’). These chronic victims believe that the scammer is a true friend, and that the relationship they have with them is real.

Why do they keep sending money?

Threats. Even people who are perfectly mentally fit may send additional funds due to threats. The Jamaicans can use Google earth to look at an actual picture of the victim’s house. Then they can call, describe the house (you live in the green house on the corner with white shutters, for example), and claim to be nearby, perhaps directly across the street. They sometimes threaten the victims or their families with physical violence if they do not send more money. To put it directly, I think most of us would freak out if this happened to us. There are no instances I have heard of where anyone actually followed through on these threats.

Sunk Costs. When people have already sent some money they are already invested in the transaction, and often believe that sending just a little more will produce the money they are promised. This may be true especially when family members, their bank and local authorities have warned the victim that it is a scam. The scammers learn of this and use this information to encourage the victim to trust them instead and send more -- with statements that the victims is smarter than those attempting to warn them and this will be proven when the funds arrive. Thus the loss numbers can increase dramatically over time.

Negative Life Events. In a nationwide phone survey of consumer fraud the FTC asked victims whether in the last two years they had “experienced a serious negative life event, such as a divorce, the death of a family member or close friend, a serious injury or illness in your family, or the loss of a job.” Those who had such an event were two and a half times more likely to have been a fraud victim.

Mental Decline. Of course there are some people who are suffering cognitive difficulties such as Mild Cognitive Impairment, dementia or Alzheimer’s disease. These people often continue to send money on one pretext or another, often sending hundreds of thousands of dollars. For example, not long ago I heard from a law school friend whose father was a retired college president. He had sent tens of thousands of dollars to these scammers. In another case reported by CNN, an older man suffering from Alzheimer’s continue to send all of his funds and committed suicide at the end when the money never appeared. http://www.cnn.com/2015/10/07/us/jamaica-lottery-scam-suicide

Here is another fairly recent story from a TV station in San Diego that does a nice job of explaining how a victim was defrauded. https://www.youtube.com/watch?v=wSrVOvtgYws.

Why Jamaica?

Jamaica is an English speaking company, and has been used by U.S. companies in the past which had outsourced their consumer service telephone lines to operations in Jamaica. This seems to have provided some training in telemarketing to at least a core of people. The locus of this fraud in Jamaica has been St James parish, home of Montego Bay, but seems to be expanding into other areas.

When frauds are successful they tend to grow quickly as more people learn how to operate them. Telemarketers break off and form their own separate operations, hiring additional people and increasing the amount of fraud. Frauds also tend to locate in places where the frauds believe there is little risk of criminal prosecution. In addition, the money provided by any fraud can at times be used to corrupt public officials. In any event this fraud took root in Jamaica and, as the charts above demonstrate, it has flourished there.

In addition, over the last 20 years or more it has become quite inexpensive to make international calls. The area code for Jamaica is 876. This is a dead bang giveaway that the call is from Jamaica, and calls from 876 should never be answered. Unfortunately, scammers are getting more sophisticated technologically, and are spoofing numbers so that they appear to be coming from within the U.S. or Canada. Many seniors do not understand concepts like spoofing phone numbers, the dangers of being on a lead list, or responding to a targeted email or letter announcing you have won.

So how do the Jamaicans know who to call?

Like many telemarketers, the frauds buy lists of names of potential victims. These are known as lead lists. Of course there is a very large and legitimate industry which sells names for marketing purposes. Simply google the term “buy telemarketing leads” and hundreds of sellers will appear. Fraudsters also purchase lists, sometimes through back channels. The frauds themselves also sell lists of people who have already been victims of other frauds. These are known in the fraud industry as “sucker lists.” In addition, some frauds use these lists to call and claim that they can help consumers recover money lost to a previous fraud – for a fee. These are known as recovery room frauds.

As noted above, one lead list seller, Sanjay Williams, has been prosecuted in the U.S. But it is likely that most of the lists originate from a different fraud. Every year millions of consumers receive mailings telling them that they have won a large sum of money, and simply have to send in $20 or so in a preaddressed envelope to receive the supposed winnings. Once they do, they can end up getting 30-40 pieces of ‘junk mail’ a day in fraudulent solicitations and fake psychics promising a bright financial future -- for a fee. The Federal Trade Commission has done several cases against such fraud over the years.

Here the press release for one recent case against deceptive prize mailings: http://www.cnn.com/2015/10/07/us/jamaica-lottery-scam-suicide/

Here is a link to the FTC’s court brief explaining this fraud: https://www.ftc.gov/system/files/documents/cases/150521mailtreememo.pdf

In addition, there has recently been major worldwide effort to attack these frauds. In the very near future I will provide a more detailed look at these efforts

www.justice.gov/opa/file/895166/download

Jamaican officials tell us that these leads are incredibly valuable in Jamaica. In 2015 Jamaica had its highest murder rate in five years, with 1196 murders. An article in the Jamaican newspaper attributes this to violence between rival telemarketing gangs. And it notes that although Jamaica has roughly the same population as Chicago, the murder rate is four times that of the Windy City. http://www.jamaicaobserver.com/news/Jamaica-homicides-jump-20-per-cent--highest-level-in-5-years_48331.

How do consumers send the money?

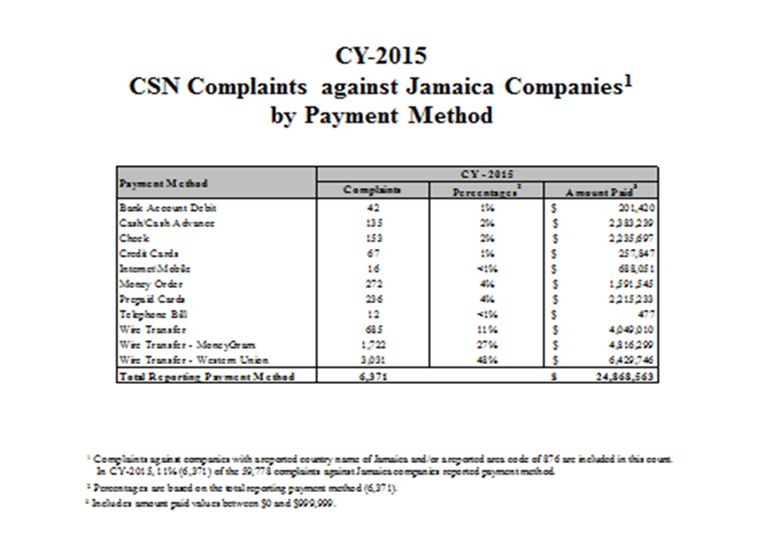

As I’ve said before, there is no point in running a fraud if you can’t get paid. Once again, the payment methods of choice are Western Union and MoneyGram. As the chart below illustrates, 75% of the time the money goes through those two companies.

Complaints in 2014 show that 26% paid by prepaid cards in 2014. Here is how those work.

A Green dot card can be used just like an ATM, or debit, card. If I have a Green Dot card it must be registered with Green dot’s computer system. How do I add more money to the card? I go to Wal-Mart or another store with cash and buy a MoneyPak card (these are nothing more than a piece of cardboard with a scratch off number on it). The store adds the money to the Green Dot system, and I scratch off the number and enter it into my online Green Dot account. Green Dot then adds the money to my account electronically. I can then withdraw the money from an ATM machine or purchase goods with my “debit” card.

What the Jamaicans and other fraudsters figured out was that they could have someone else provide cash, obtain the Moneypak card, scratch off the number, and simply read that number over the telephone to the fraudster. This information can then be entered into the Green Dot computer system from any location or country.

There are other cards – Vanilla Cards and Reloadit cards are some -- available at many retail locations that work exactly the same way. Some of the others can also be reloaded through the Green Dot MoneyPak’s.

This is a bit disturbing. Green dot had ended the use of its MoneyPak cards and changed to a system in which to put more money on a Green Dot card the owner would have to produce the actual card and cash to reload it. They had made this change in response to the large amount of fraud that employed the MoneyPak. But earlier this year they resumed the use of these cards.

Finally, frauds have recently begun asking people to go to an Apple store and purchase I-Tunes gift cards. Again, the numbers from these cards can be read over the phone to the fraudsters. The numbers cannot be used to purchase Apple electronics, but there is apparently a large underground market for these gift cards.

Western Union

Even Western Union has recognized that it has had a problem in Jamaica. The main legitimate purpose of Western Union and MoneyGram is for family members working in the U.S. to send money back to relatives in their home countries. I’ve heard estimates that there are more native Jamaicans in the U.S. than in Jamaica. Most remittances sent from the U.S. to family members in Jamaican are for only three hundred dollars or so. Thus transfers for $1000 or more, a common loss for a fraud, stand out in the Western Union system.

In 2012 Western Union temporarily closed all thirteen of its Western Union offices in St. James parish (Montego Bay) after reportedly imposing additional security procedures.

I am aware of no legitimate business that requires payment by Western Union or MoneyGram. In fact, earlier this year the FTC amended the Telemarketing Sales Rule to make it ILLEGAL for anyone in a telemarketing transaction to obtain payment by Western Union, MoneyGram, or through a stored payment card such as Green Dot. Thus anyone asking for payment this way in a telephone transaction is violating the law.

Theft of government benefits

Many of the victims of this fraud are also eligible for government benefits from Social Security or the Veteran’s Administration. Social Security no longer issues paper checks, but instead does direct deposit into bank accounts or onto stored value cards. The frauds are sometimes able to obtain enough personal information about the victim so that they can log onto government web sites and divert monthly payments to themselves. It is hard to quantify how much this is happening, but in Congressional testimony in September 2012 the SSA Inspector General reported 19,000 questionable payments, with some of them clearly going to Jamaican frauds.

https://oig.ssa.gov/newsroom/congressional-testimony/hearing-direct-deposit-social-security-benefits

The Senate Aging Committee has held hearings on this topic, and discusses the problem in an excellent report it issued in December 2014. http://www.aging.senate.gov/imo/media/doc/Fraud%20Hotline%20Report%20Final%20Version.pdf

There have been several prosecutions for this activity. See: https://oig.ssa.gov/audits-and-investigations/investigations/june5-lotteryscam

Use of money mules

As Western Union, MoneyGram, and Green Dot have made increased efforts to limit the flow of money directly to Jamaica the frauds there have turned to extensive use of money mules. They have someone else in the U.S. receive the money and then send it on to Jamaica or to a Jamaican gang member living in the U.S. or Canada. The census bureau estimates that that there are roughly 750,000 Jamaicans living in the U.S. http://names.mongabay.com/ancestry/Jamaican.html While most of those people are doubtless honest and hard-working, we know that there are many people willing to help laundering money for a cut of the proceeds (and not just Jamaicans).

In at least one instance a woman from Jamaica flew to Georgia to convince an elderly woman to continue sending money. Vania Lee Allen even impersonated an FBI agent to get the victim to call a coconspirator in Jamaica in order to keep the fraud going. Ms. Allen was arrested in the U.S. and prosecuted. https://www.justice.gov/opa/pr/woman-pleads-guilty-impersonating-fbi-agent-connection-lottery-fraud-scheme-based-jamaica . Last week she pleaded guilty and was sentenced to 40 months in prison: http://www.loopjamaica.com/content/woman-sentenced-impersonating-fbi-agent-jamaican-lotto-scam

In addition, the frauds also draw repeat or chronic victims into helping them move the money. When the crooks are convinced that the victim has no more money to send, they promise that a third party in the U.S. will send them part of their winnings, at times claiming it is reimbursement for some of the money they have lost. Thus they use older fraud victims to receive money from OTHER victims and then send the money to Jamaica. In fact, at least one older victim with Parkinson’s disease did as asked and flew to Jamaica with $9000 in cash. He was arrested and sent home. https://www.youtube.com/watch?v=8cTo6dh39ls

What is law enforcement doing to fight this problem?

U.S. and Jamaican authorities are working together to fight this fraud. Agencies in both countries have been working together, organizing as Project JOLT (Jamaican Operations Linked to Telemarketing). Project Jolt includes, in part representatives of the Postal Inspection Service, Homeland Security Investigations (or HSI, part of the Department of Homeland Security), the Federal Trade Commission, DOJ and Jamaican law enforcement. Both Homeland Security Investigations and the Postal Inspection Service have people stationed full time in Jamaica, working with Jamaican law enforcement.

There have been real efforts to prosecute in Jamaica, to prosecute Jamaicans and others in the U.S. assisting the fraud, and efforts to extradite Jamaicans to the U.S. to stand trial.

Arrests and prosecutions in Jamaica

Jamaican law enforcement has executed search warrants and arrested hundreds of those involved in lottery fraud in Jamaica. In 2013 Jamaica passed a new law aimed directly at lottery fraud.

There is a real interest in Jamaica in taking on this fraud. However, Jamaica is a very poor country without a sizable budget for law enforcement. Thus efforts in the U.S. will remain important.

http://www.jamaicaobserver.com/news/More-than-500-arrested-under-Lotto-Scam-Act

As noted before, Montego Bay has been the epicenter of this fraud in Jamaica. But as law enforcement has increased the pressure the fraud has moved to different locations, and law enforcement has followed. Recently eleven people were arrested in police raids in St. Mary and St. Ann’s Parish in Jamaica by lottery scam task force

https://www.youtube.com/watch?v=BvonJs_MNeM

Prosecutions of Jamaicans in the U.S.

There have now been many prosecutions of those physically in the U.S. working with Jamaican scammers.

A New York man was sentenced to four plus years in federal court for working with Jamaicans to scam those in the U>S.

http://www.masslive.com/news/index.ssf/2016/08/ny_man_sentenced_to_4_years_in.html

A Schenectady man pleads guilty to working with Jamaicans on lottery scam

http://wnyt.com/news/schenectady-man-jeragh-powell-admits-to-role-in-jamaican-lottery-scam/4218410/

http://www.timesunion.com/local/article/Feds-Schenectady-couple-scammed-elderly-in-9004225.php

Jamaican law student and coconspirators arrested in NY for lottery scam

http://www.yardflex.com/2016/06/jamaican-law-student-was-involved-in-lot.html

http://www.loopjamaica.com/content/how-law-student-teresa-wilson-and-friends-got-busted

http://www.dre1allianceent.com/lottery-scammer-law-student-teresa-wilson-passes-final-exams/

https://www.justice.gov/usao-mdfl/pr/two-florida-residents-charged-jamaican-lottery-scheme

Jamaican prosecuted in New Jersey:

http://www.nj.com/news/index.ssf/2016

Jamaican woman from NYC with dual citizenship prosecuted in North Carolina

Extradition from Jamaica and Prosecution in the U.S.

There were originally concerns in Jamaica about extraditing those engaging in fraud. There were riots in Kingston several years ago (2010) when there was an effort to extradite a drug kingpin to the U.S. https://en.wikipedia.org/wiki/2010_Kingston_unrest

This problem has now been overcome. In April of 2015 Damian Barrett was extradited to the U.S. to stand trial. This was the first extradition from Jamaica for lottery fraud. Barrett later pled guilty. http://www.sun-sentinel.com/news/crime/fl-jamaican-lottery-fraud-extradite-20150410-story.html

Jamaican news sources also report that the District of North Dakota (which prosecuted Sanjay Williams) has issued arrest warrants for an additional 26 Jamaicans, with extradition requests pending in Jamaica for 14 people. Eight of those have been arrested in Jamaica and are in extradition proceedings. Another six have yet to be located. http://jamaica-gleaner.com/article/news/20160821/running-uncle-sam-us-hunts-thousands-suspected-jamaican-lottery-scammers-face

A Jamaican police officer was among those who were wanted for extradition

http://www.jamaicaobserver.com/news/Cop-among-7-facing-extradition-for-lotto-scam_56257

The Justice Minister in Jamaica has made it clear he will support these efforts and sign the extradition requests.

What affect is this having on Jamaica?

Despite the massive amounts of money flowing into Jamaica this fraud is having devastating effects on the country. The number of murders alone has caused serious concerns. Jamaica’s largest source of income is tourism, and the violence and wide spread fraud threaten to deter visitors. Even innocents have been killed there. In 2013 an eight year old girl was visiting Jamaica from London and was killed in a shooting that seems to have stemmed from lottery fraud activity: http://www.bbc.com/news/uk-england-21002359

In addition, there is an entire generation of Jamaican youngsters that are attracted to the quick wealth of engaging in lottery fraud. The Jamaican police have even done training in schools there to discourage younger people from becoming involved in fraud:

http://jamaica-gleaner.com/article/news/20160727/schools-embracing-anti-lotto-scam-message-out-west

Luis Moreno, the U.S. Ambassador to Jamaica, has made attacking lottery fraud one of his priorities. He is quoted as saying: “If we do not do more, the cultural and economic distortion that this dirty money brings could destroy a whole generation,” said Moreno.

How can you detect and prevent sweepstakes/lottery fraud?

I would hope that most of those reading this piece would avoid a lottery fraud. However, my hope is that readers will pay attention so that they can help protect their own friends and family from being defrauded.

Here are some tips to share.

If they want money they are crooks. No true lottery or sweepstakes ever asks for money before providing the winnings. None. So if they want money they are crooks. Count on it.

Call the Lottery or Sweepstakes Company directly to see if you won.

PCH does have a lottery, of course, but does not make cold calls to consumers. PCH has a specific warning about Jamaican lottery scams, as well as a fraud hotline to report PCH imposters: http://info.pch.com/component/content/article/11-fraud-protection/65-beware-of-publishers-clearing-house-scams-from-jamaica

Call PCH to see if you actually won 800-392-4190

Check to see if you won a lottery. At times these frauds pretend to be Mega Millions or another large lottery. Call the North American Association of State and Provincial Lotteries at

440-361-7962 or your local state lottery agency.

Do an internet search of the telephone number. Many people do not know that you can search a phone number. But you can, and often the same number has been reported as fraudulent by someone else.

Law Enforcement does not call and award prizes. Over a six month period while I was at the FTC I received at least half a dozen calls from consumers who thought I had called and told them they had won a lottery. Most callers had captured 202 area codes, but were able to locate me (my area code was 312). These individuals had been told that since there was so much fraud in lotteries that the FTC had taken over the job of awarding prizes. I know many other people at the FTC whose names were used. If you think you have been contacted by law enforcement check it out yourself and be sure – and do not send money until you do.

Talk to a trusted family member or your bank. They may be able to help.

File a complaint

The Federal Trade Commission (FTC) https://www.ftccomplaintassistant.gov/ or call 877-FTC-Help. The FTC database of fraud complaints is available on line to over 3000 law enforcement agencies. Because it contains a great deal of personal information on fraud victims it is not available to the general public. It can be searched fairly easily, and may well locate several victims defrauded by the same person.

For law enforcement help I recommend beginning with the Postal Inspection Service. Postal Inspectors are federal agents, and the agency is devoting a great deal of attention to this type of fraud – even if the mail is not being used. See their warning at: http://about.usps.com/news/state-releases/oh/2014/oh_2014_0722.htm . The USPIS may also have some resources to assist with chronic victims.

Other Places to complain in the U.S.

The Better Business Bureau. www.Bbb.org to find your local Bureau

National Consumers League: www.fraud.org

Senate Subcommittee on Aging Fraud hotline: http://www.aging.senate.gov/press-releases/senate-aging-committee-launches-new-anti-fraud-hotline-enhanced-website-to-assist-seniors 1-855-303-9470

Western Union 1-800-448-1492; https://www.westernunion.com/us/en/file-complaint.html

MoneyGram 1-800-926-9400; http://global.moneygram.com/nl/en/how-to-report-a-problem

Green Dot. 1-866-795-7597 https://www.greendot.com/greendot/account/contact-us

Canadian Law Enforcement: http://www.antifraudcentre-centreantifraude.ca/reportincident-signalerincident/index-eng.htm If there is a connection to Canada the CAFC is a wonderful resource, and they have very talented people. You can also call them toll free from the US at 1-888-495-8501

Victims can call local police, especially if threats are being made.

If victims are seniors or other vulnerable adults they may be able to obtain help through Adult Protective Services, which has offices in every state and many counties. This is elder financial exploitation. It is a crime. Find your local office at www.elderjustice.gov.

Other resources

FTC warning about Jamaican Lottery Fraud: https://www.consumer.ftc.gov/articles/0119-jamaican-fraudsters-targeting-us-consumers

State Department warning from the U.S. embassy in Jamaican: https://kingston.usembassy.gov/service/scams.ht

I highly recommend an excellent CNBC piece on their American Greed program that examines Jamaican lottery scams. It is 43 minutes long: https://www.youtube.com/watch?v=563zNg7GjLU

About the Author: Steve Baker

Steve recently retired as Director of the Federal Trade Commission’s Midwest Region in Chicago. He has worked directly on consumer fraud issues for over thirty years, and regularly worked with foreign counterparts. Steve was the main FTC representative and helped form Project JOLT. He has been to Jamaica.